Our credit products include income generating loans and other loan products for various household purposes

Our insurance products include life and health insurance covers issued and underwritten by certain Indian insurance companies with whom we have entered into tie-ups.

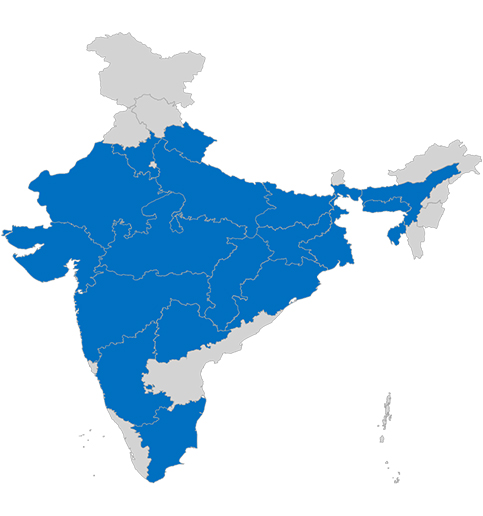

(as defined in the CRISIL Report) Data as of March 31, 2024

We offer collateral free loans to customers who are willing to borrow in a group and agree to accept joint liability for the group's loans, which we refer to as the joint liability group model ("JLG model").

Our JLG Model enables our customers, who typically do not have sufficient collateral, to gain access to formal credit. This model also provides a community support system for our customers, regardless of their financial circumstances.

Aavishkaar Group provides business solutions to assist sustainable enterprises dedicated to social and environmental change, has advised a large number of organisations on inclusive business strategies and has provided significant amounts of venture capital funding to social impact businesses.